news

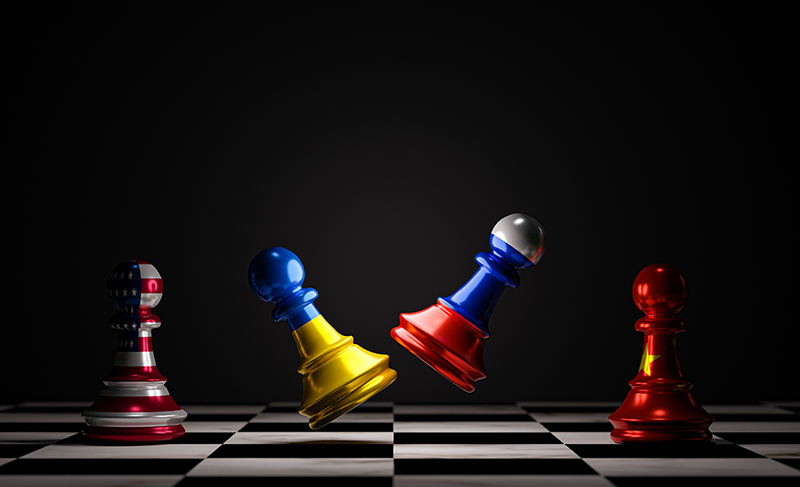

The Butterfly Effect…….on steroids!

Difficult (ie negative) market conditions continue to persist. At the time of writing, the ASX 200 is down 10.95% for the year. Before you get overly concerned, this particular index doesn’t include dividends, which always generate a positive return of approximately 4.5% (excluding franking credits). S&P/ASX 200 Index - 1 yr movement to 18 October