Interest rate announcement – July 2017

Today the Reserve Bank of Australia met to review the official cash rate. After last cutting rates in August 2016, the RBA have again decided to leave rates on hold at 1.50% this month. Nonetheless, we have seen some lenders starting to increase their variable and fixed interest rates and we expect others to follow suit.

Did you know you can now use super to save for your first home tax effectively?

From 1 July 2017, you can save tax effectively for your first home using your super account. Under the new arrangements, you can make additional voluntary contributions (such as salary sacrifice contributions) and then access those contributions plus interest at a deemed earnings rate (currently around 4.7%) from 1 July 2018 when you come to buy your first home. You can make up to $15,000 of voluntary contributions per financial year (up to an overall total of $30,000).

Making these contributions via salary sacrificing to super can be tax effective as they come from your pre-tax salary and are therefore taxed at the concessional superannuation rate of 15% rather than at your marginal tax rate.

Example

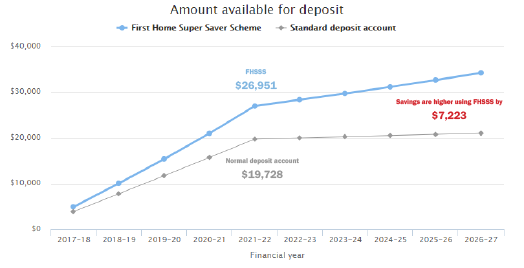

Claudia is 25 years old and trying to save a deposit to buy her first home. She is 25 years old and earning $50,000pa. If she were to use the First Home Super Saver Scheme (FHSSS), salary sacrificing $500pm (or $6,000pa), which would only reduce her net take home pay by $320pm (or $3,840apa), within 5 years, she will have saved $26,951.

First home owner incentives by state

New South Wales

- No stamp duty payable on all homes (existing and new) up to $650,000.

- Reduced stamp duty payable on all homes (existing and new) between $650,000 and $800,000.

- $10,000 First Home Owner Grant on new homes up to $750,000 and purchases of existing homes up to $600,000.

Victoria

- No stamp duty payable on owner occupied homes purchased for up to $600,000.

- Reduced stamp duty payable on homes valued at between $600,001 and $750,000.

- First Home Owner Grant of $10,000 on homes valued at less than $750,000. This First Home Owner Grant increases to $20,000 for new homes in regional Victoria that are valued up to $750,000. Click here to find see the areas that are eligible for the higher $20,000 grant.

Tasmania

- First Home Owner Grant of $10,000 available on new and existing homes.

- If purchasing a new home, purchasing off the plan, or building your home through a registered builder / as an owner builder, the First Home Owner Grant will increase to $20,000 between 1 July 2016 and 1 July 2018.

Please contact us if you would like any more information about first home owner incentives in your area.

Our Current Best Interest Rates

The best home loan rates we currently have available:

- Variable rate of 3.74% pa

- 1 year fixed rate of 3.69% pa

- 2 year fixed rate of 3.69% pa

- 3 year fixed rate of 3.78% pa

- 4 year fixed rate of 4.34% pa

- 5 year fixed rate of 4.19% pa

(3.99% for first home buyers)

Conditions apply – see Harvest for details