Socially Responsible Investment (SRI) takes into consideration not only the financial returns of a company but the social impact it makes. This can involve various levels of social responsibility from sustainability themed investing, negative screening (avoiding certain types of companies, for example, alcohol, gaming and tobacco) to best practice in relation to environmental, social and governance factors. It is becoming evident that responsible and ethical investing is receiving more mainstream attention in Australia, and that people want to align their investments with companies that share their values.

The Responsible Investment Association Australasia (RIAA) ‘Responsible Investment Benchmark Report 2015 Australia’ finds that “the myth of under performance of responsible investments is unfounded.” The RIAA’s goal is to see more capital being invested into sustainable assets that underpin strong investment returns and a healthier economy, society and environment.

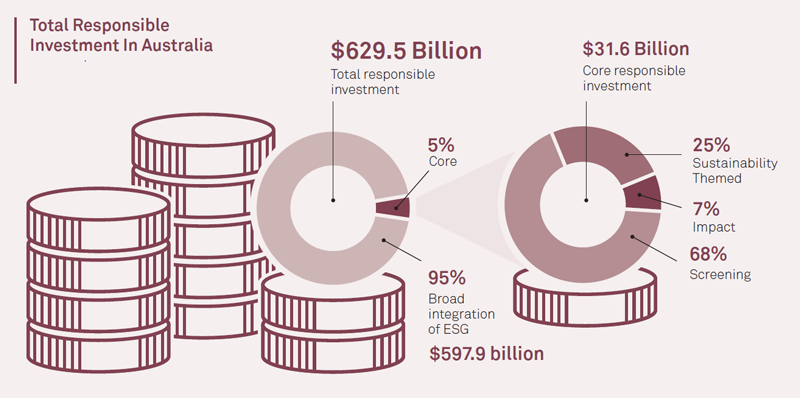

Already by the end of 2014 the assets under management for responsible investment in Australia has risen to $629.5 billion. These investments have started from a low base, and are continuing to grow. Most large fund managers now include at least one SRI style fund in their investment suite. Socially responsible investors recognise that there is more to investment outcomes than what can be found in the financial reports.

As part of our investment approach we specifically exclude investments that earn the majority of their earnings from the gambling, tobacco or armament industries. When we select managed investments we do not automatically allocate any prescribed allocation to socially responsible funds. However, we do consider these funds and review them on their investment merits and frequently include some socially responsible investment funds in our client portfolios.

If you would like to learn more about SRI investing, please contact us to discuss further. We can assist with developing a strategy tailored to you and your investment values.