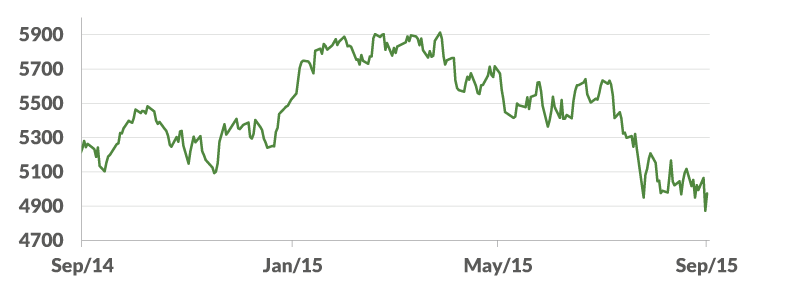

The Australian share market has experienced a very difficult period since March 2015. We have summarised some of the key impacts on Australian shares, looking at the macro level and micro level factors that are playing a part.

Macro level factors

Earnings growth: Over the next two years there is an expectation that the Australian share market earning growth will be lower than the previous two years.

China’s slowing growth: As a key trading partner for Australia, slowing growth in China will have a direct impact on demand for Australian exports going forward.

Global investment: Typically around half of the Australian share market is owned by foreign investors, and the current trend is for overseas investors to favour share investments in other parts of the world.

Micro level factors

Banking sector: In March the bank share prices were at record levels. Since then loan growth has slowed, earning expectations have been lowered and all the banks have had to raise additional capital which will dilute earnings. Banks are now trading at fair value.

Resources and energy sectors: Resource stock prices are down significantly due to the slowing in China and the lower demand for energy and commodities. They are expected to remain at the current low levels for an extended period of time.

Other stocks: The strong earnings growth experienced in recent years is now slowing down, for example, Woolworths has had two earnings downgrades this year. The benefits from a drop in the Australian dollar, for companies earning revenue overseas, is now reducing as the dollar stabilises.

Overall, we rate Australian companies as being in a strong financial position, and that they will continue to pay growing dividends. We see the current market conditions as a time to hold on to existing investments, and potentially, a chance to buy into the Australian share market with any new/additional investments.

Harvest has been managing share portfolios for our clients since 2010. Our Harvest Income Equities Portfolio targets an income return 1% above the index. The share portfolio delivered returns of 13.8% p.a. for the five years to 30 June 2015, outperforming the ASX300 index by 4.3% over the same period.

If you would like to discuss the implications of these factors on your portfolio please contact us to discuss further. We can assist with developing an investment strategy tailored to your situation, or with the review of your existing investment strategy.

Harvest Income Equities Portfolio

Performance to 30 June 2015