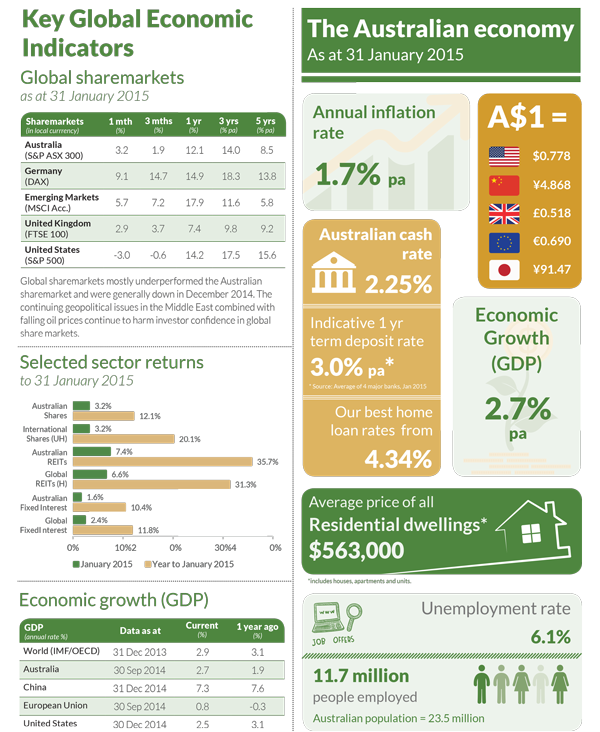

The official cash rate is now 2.25%, and many investors are still holding cash in online savings accounts and term deposits which are typically paying around 3.0% to 3.5% pa.

While it’s accepted that interest rates will head higher again at some point, there are differing views as to whether the RBA will cut the cash rate further in the shorter term.

Overall, our view is that interest rates will remain close to the current levels for the next two to three years, and maybe even up to five years.

Implication for Investors

For very conservative investors it will still be appropriate to have all your investments in cash and fixed interest. We expect that you can achieve an investment return in the range 3-3.5% pa over the next 1 to 2 years.

For conservative investors it will still be appropriate for the majority of investments to be in cash and fixed interest. However a small exposure (e.g. up to 30%), to Australian shares and Listed Property Trusts over the longer term (i.e. periods of 5 to 7 years). We expect with this mix of investments you can increase your investment return to be in the range of 4-5% pa over 5 to 7 year periods.

For balanced investors it will be appropriate for roughly 30-50% of your investments to be in cash and fixed interest. However the other 50-70% to be in Australian shares, International shares and Listed Property Trusts over the longer term (i.e. periods of 5 to 7 years). We expect with this mix of investments that you can increase your investment return to be in the range 5-7% pa over 5 to 7 year periods.

For aggressive or high growth investors it will be appropriate to have up to 20% of your investments to be in cash and fixed interest. However the other 80-100% to be in Australian shares, International shares and Listed Property Trusts over the long term (i.e. period of 7 to 10 years). We expect with this mix of investments that you can increase your investment return to be in the range 7-9% pa over 7 to 10 year periods.

In the coming newsletters we will delve further into the asset classes of cash, fixed interest, shares and listed property to discuss the points to consider in a low interest rate environment.

Director’s Comment

The Australian share market is up approximately 8% (S&P ASX 300) so far in 2015. This movement reflects an expectation that the official interest rate will be reduced by an additional 0.25%, down from the already record low of 2.25%, and stay low for at least the next 2 to 3 years. While this has been positive for investors in Australian shares, it now puts the market at the high end of “fair value” in our view. We expect Australian shares to continue to provide good returns over the next 2 to 3 years, however there are still risks in global equity markets. For portfolios that are now significantly overweight in equities it is a useful time to review and potentially reduce the overweight position to a more neutral stance.

Click here to download a copy of this newsletter as a PDF.

Leave A Comment

You must be logged in to post a comment.