Director’s Perspective

By Mario Isaias

Welcome to our last edition in 2014 of our Investment Newsletter. We are excited to announce that in 2015 we will be revamping this newsletter to enhance the content and timing. We know you will enjoy this fresh approach.

November in Australia was generally a “minus 3% month”. Both the stock market and the Australian dollar fell about 3%. Iron ore and oil prices also fell, with the latter falling by a staggering 15%. This can however be good as lower oil prices means the price of petrol and energy is falling giving, consumers more money to spend elsewhere in the economy. This is also good for business and therefore good for economic growth in Australia. The US market also continues to do well. China decreased its official interest rates in November to which their share market responded with a 10.9% increase. Seasons greetings and a happy new year from the Harvest team.

Regional Commentary

Australia

Monetary policy – the Reserve Bank of Australia (RBA) left the cash rate unchanged at 2.5% at their December 2014 meeting for the fifteenth consecutive month. In their accompanying statement, the RBA continued to maintain the view that despite recent falls, the Australian dollar “still remains well above most estimates of fair value”.

Growth – GDP growth in Australia for the September Quarter of 2014 was confirmed to be well below estimates. Over the Quarter, GDP grew by 0.3% (previously estimated to be 0.7%) which brought the annual GDP growth rate for the year to 30 September 2014 to 2.7% (initially estimated to be 3.1%).

Employment – The Australian Economy created 42,700 jobs in November 2014, however, despite this, the seasonally adjusted unemployment rate also increase by 0.1% to 6.3%.

United States

Growth – The annual GDP growth rate in the US to the end of the September quarter 2014 was revised up to 3.9% from 3.50%. This upward revision was primarily due to higher than expected levels of business investment and consumption during the quarter.

Manufacturing – Manufacturing in the US continued to improve in November, however, the rate of improvement fell slightly with the US ISM Manufacturing PMI Index easing to 58.7 (down from 59.0 in October).

Employment – The US economy created 314,000 jobs in November, which was above expectations of 225,000. Despite this however, the unemployment rate remained unchanged at 5.8% for the month. The participation rate also remained unchanged at 62.8%.

Europe

Employment – The official Eurozone rate of unemployment remained flat at 11.50% in November 2014 with the highest rate of unemployment once again being forecast in Greece at 26.4%

Manufacturing – Manufacturing within the Eurozone continued to improve for the sixteenth consecutive month in November 2014, however, the pace of improvement slowed slightly with Eurozone Manufacturing PMI declining to 50.4 for the month (down slightly from 50.6 during the previous month).

China/Japan

Growth – Japanese GDP declined by 0.5% during the September quarter of 2014 and was well below the forecast of 0.5% growth for the quarter. This means that GDP in Japan has now declined by 1.3% over the year to 30 September 2014 and having recorded two consecutive quarters of negative GDP growth, Japan is now in a technical recession.

Manufacturing – Manufacturing in China continued to expand in November 2014, however, the rate of expansion fell slightly to 50.0 (down from 50.4 in October).

Manufacturing activity in Japan also continued to expand in October but at a decreased rate with the Japanese Manufacturing PMI falling to 52.0 in November 2014 (down from 52.4 in October).

Selected Global Manufacturing PMI Indicators

As at 30 November 2014

Note: the above is a trend line. Score above 50 indicates improvement

Source: RBA, ABS, Datastream

Commodity Prices

Commodity prices were generally weaker in November 2014. The Oil price fell by a further 14.8% to US$71.95 per barrel and the Iron Ore fell by 13.6% to US$70 per metric tonne. Gold prices were the exception, rising by 1.4% to $1,181.97/oz.

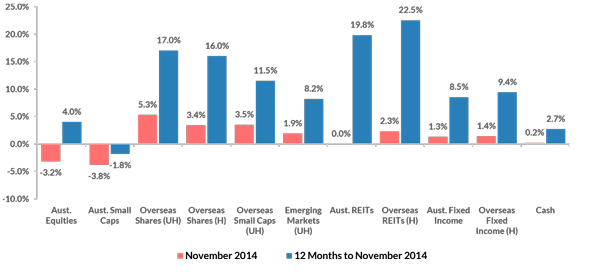

[jbox vgradient=”#fdf2ea|#fdf2ea” shadow=”7″ jbox_css=”border:1px solid #f26522;” title=”Harvest’s View“]The Australian share market was down 3.2% over the month of November 2014. The main driver of this fall has been increasing concerns over global economic growth. Our belief is that the market is still currently at fair value. We expect the Australian Equity market (as measured by the ASX 200) to continue to finish the year at around 5,450 points.[/jbox]Asset Class Returns for Selected Monthly Indicators to November 2014

Source: Thomsen Financial Datastream; MSCI data provided ‘as is’. Prepared by Harvest Financial Group

Selected Market Indicators Commentary to 30 November 2014

Australian Shares

The Australian share market fell in November 2014 with the S&P ASX 300 Accumulation Index returning -3.2% for the month. Both small cap stocks and large cap stocks were down returning

-3.5% and -3.8% respectively. The best performing sectors for the month of November were Healthcare (+1.2%) and Telecommunications (+1.2%) while Energy (-13.1%) and Consumer Staples (-8.1%) were the weakest.

Global Shares

Global share markets performed well in November 2014 with the MSCI World (ex. Australia) Index returning +3.4% on a fully hedged basis on the back of strong US retail sales growth and a further upward revision in the annual GDP growth rate for the US to the end of September (revised up to 3.9% from 3.5%).

The strongest performing global sectors for the month were Consumer Discretionary (+8.8%) and Information Technology (+8.0%) while Energy (-6.0%) and Utilities (+3.6%) were the weakest.

Markets in the U.S. were once performed strongly with the S&P 500 Composite Index (+2.7%) and the NASDAQ (+3.5%) both recording positive returns for the month in local currency terms.

European markets were generally up in November on the back of higher than expected GDP growth results with GDP growing by 0.2% (up from an initial forecast of 0.1%) for the September quarter of 2014. Markets in Germany (+7.0%), France (+3.8%) and the UK (+3.1%) were all up for the month of November 2014.

Asian markets also followed the trend and were generally up in November with the Japanese TOPIX (+5.8%), the Chinese Shanghai Composite Index (+10.9%) and the Indian Mumbai Sensex 30 (+3.1%). Monetary policy easing in Japan and China, particularly the People’s Bank of China’s decision to cut benchmark interest rates for the first time since July 2012, helped to buoy investor confidence.

Property

Domestic Real Estate Investment Trusts (REITs) were flat in November 2014, while Global REIT’s were up, returning +2.3% on a fully hedged basis.

Fixed Interest/Bonds

Global sovereign bond yields were generally down in November 2014 with 10 year bond yields falling in the UK (-0.32% to 1.93%), Germany (-0.14% to 0.70%), Japan (-0.04% to 0.42%) and remained flat in the US (0.47%).

Australian bond yields also fell in November with 10 year bond yields falling -0.26% to 3.03% and 5 year bond yields falling -0.24% to 2.57%).

Australian Dollar

The Australian dollar was mixed in November 2014. The $A depreciated against the US dollar (-2.9%), the Euro (-2.5%) and the Pound Sterling (-1.9%), while it appreciated against the Japanese Yen (+3.5%).

Click here to download a PDF of this newsletter.

Leave A Comment

You must be logged in to post a comment.